True Forex Funds is dedicated to bolstering traders on their journey towards trading mastery. Their guiding principle is to empower traders with the autonomy to execute trades according to their individual strategies, free from restrictive oversight. This unique approach offers traders the chance to garner impressive profits. They are afforded the flexibility to oversee accounts up to $200,000 in size, coupled with the advantage of retaining 80% of the profits generated. Achieving these gains is made feasible through the trading of a diverse spectrum of financial instruments, encompassing forex pairs, commodities, indices, stocks, and the dynamic realm of cryptocurrencies.

Table of Contents

- Who are True Forex Funds?

- Who owns True Forex Funds

- Funding Program Plans

- In-depth Look at the Standard Offer

- Quick Funding

- Timeless Funding Program

- One-phase Funding plan

- What broker does true forex funds use?

- Trading Instruments at True Forex Funds

- Trading Fees

- True Forex Funds Trustpilot reviews

- Summary and Recommendation for True Forex Funds

- Conclusion

Who are True Forex Funds?

True Forex Funds, also known by its formal title TFF International Kft., emerged in the trading world in October 2021. Nestled in the heart of Győr, Hungary, this proprietary trading firm thrives under the stewardship of CEO Richard Nagy. Offering a diverse palette for traders, it presents four distinct account types, along with a choice of three two-step evaluations and a streamlined one-step evaluation. In collaboration with a tier-1 liquidity provider, True Forex Funds prides itself on delivering an unparalleled simulation of real market conditions, setting a high standard in the realm of brokerage services.

| Incorporation Date | October 2021 |

| CEO | Richard Nagy |

| Office Location | Győr, Hungary |

| Maximum Allocation Capital | $400.000 |

| Broker | Liquidity Provider |

Who owns True Forex Funds

Richard Nagy is the CEO of True Forex Funds sadly there is not much info founded about him.

Funding Program Plans

True Forex Funds offers a suite of four specialized investment programs:

- Standard Offer

- Quick Funding

- Timeless Funding

- One-phase Funding

In-depth Look at the Standard Offer

The Standard Offer from True Forex Funds is a gateway for traders to oversee portfolios ranging from $10,000 to a robust $200,000. This program is meticulously designed to spotlight and cultivate traders who show both profitability and adeptness in risk control over a dual-phase evaluation journey. Engage in trading with leverage scaling up to 1:100, coupled with the liberty to choose your funding currency from options including USD, EUR, and GBP.

| Account Size | Price |

|---|---|

| $10,000 | €89 |

| $25,000 | €189 |

| $50,000 | €299 |

| $100,000 | €499 |

| $200,000 | €998 |

Evaluation Phase One: In this initial stage, a trader’s goal is to achieve an 8% profit target without exceeding a 5% maximum daily loss or breaching the 10% overall loss threshold. Note that a span of 30 calendar days is allotted to meet the profit target in this phase, with a requisite of trading for a minimum of 5 calendar days to advance to the next phase.

Evaluation Phase Two: This phase sets a profit target of 5%, maintaining the same parameters for maximum daily and overall losses as Phase One. Traders have a 60-day calendar window to reach this target, with a mandatory minimum of 5 trading days to transition to a funded account.

Successful completion of both phases entitles traders to a funded account, devoid of minimum withdrawal constraints. Adherence to the 5% maximum daily loss and 8% overall loss rules is mandatory. The inaugural payout occurs 14 days after the first position in your funded account, with subsequent bi-weekly withdrawal opportunities. Enjoy an 80% profit split on earnings from your funded account.

Standard Offer Scaling Plan

The Standard Offer incorporates a scaling strategy. Traders demonstrating profitability over three months, achieving an average return of 8%, and conducting at least three successful withdrawals, qualify for a 25% increment in account size.

Scaling Examples:

- A $100,000 account, upon meeting criteria after 3 months, ascends to $125,000.

- This $125,000 account, after another 3 months of qualifying performance, climbs to $150,000.

- Following this pattern, a $150,000 account reaches $175,000 after the subsequent three months.

Trading Rules & Objectives of the Standard Offer

- Profit Target: This is the specified profit percentage traders must attain to conclude an evaluation phase, withdraw profits, or upscale their trading account. Phase 1 targets an 8% profit, while Phase 2 aims for 5%. Funded accounts aren’t bound by any fixed profit targets.

- Maximum Daily Loss: It’s the upper limit a trader can lose in a single trading day without infringing the account’s terms. All accounts have a 5% cap for daily loss.

- Maximum Loss: This is the total loss limit a trader can incur without violating the account’s conditions. All accounts have a 10% threshold for maximum loss.

- Minimum Trading Days: The least number of days required for trading to successfully complete an evaluation phase. Both phases necessitate a minimum of 5 trading days.

- Maximum Trading Period: The longest period allowed for reaching the required profit target and concluding an evaluation phase. The first phase spans 30 calendar days, while the second extends to 60 days.

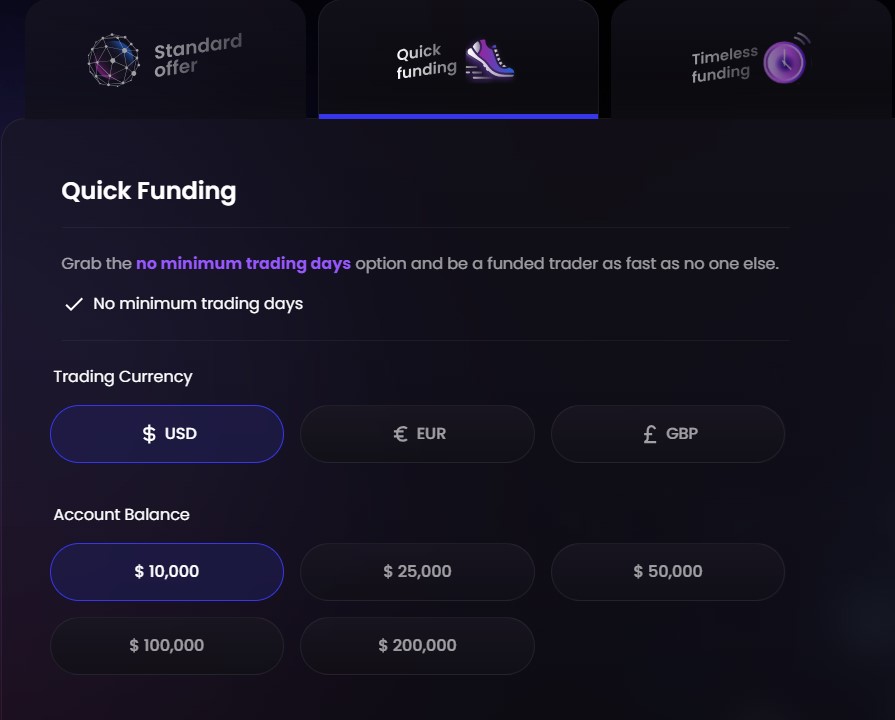

Quick Funding

True Forex Funds Quick Funding program offers traders the chance to oversee accounts ranging from $10,000 to a substantial $200,000. This program seeks to spotlight traders who not only yield profits but also master risk management across a two-phase evaluation. Quick Funding participants can engage in trades with leverage up to 1:100 and select their preferred account funding currency from USD, EUR, or GBP.

| Account Size | Price |

|---|---|

| $10,000 | €98 |

| $25,000 | €208 |

| $50,000 | €329 |

| $100,000 | €549 |

| $200,000 | €1,098 |

Evaluation Breakdown

Phase One: Traders must hit an 8% profit target without exceeding a 5% daily loss cap or a 10% overall loss limit. A 30-day timeframe is allotted to reach this profit mark in phase one, with the flexibility of not having a minimum trading day requirement before progressing to the second phase.

Phase Two: Here, the goal is a 5% profit target, maintaining the same daily and overall loss limits as the first phase. Traders have 60 days to achieve this target, again without a minimum trading day prerequisite for advancing to a funded account.

Upon successfully navigating both phases, traders receive a funded account with zero minimum withdrawal limits. It’s crucial to adhere to the 5% daily and 8% overall loss rules. The initial payout is scheduled 14 days after the first trade in the funded account, with subsequent bi-weekly withdrawal opportunities. The profit split stands at 80% of the earnings made on the funded account.

Quick Funding Scaling Plan

Quick Funding also includes a scaling plan. If a trader consistently profits over three months, averaging an 8% return during this period, and makes at least three successful withdrawals, they qualify for a 25% increase in their account size.

Scaling Examples:

- A $100,000 account, upon qualification after 3 months, grows to $125,000.

- Subsequently, a $125,000 account, maintaining qualifying performance, escalates to $150,000 over the next three months.

- Continuing this trend, a $150,000 account expands to $175,000 after another three months.

Quick Funding Trading Guidelines & Goals

- Profit Target: A specific profit percentage is set for traders to achieve in order to conclude an evaluation phase, withdraw profits, or increase their trading account. The first phase has an 8% profit target, while the second phase aims for 5%. There are no preset profit targets for funded accounts.

- Maximum Daily Loss: This is the limit on the loss a trader can incur in a single trading day without violating the account’s parameters. All account sizes are subject to a 5% daily loss limit.

- Maximum Loss: This cap represents the overall loss a trader can endure without breaching the account. The limit for all account sizes is set at 10%.

- Maximum Trading Period: This is the longest period within which traders must meet their profit target and conclude an evaluation phase. The first phase spans 30 calendar days, while the second extends to 60 days.

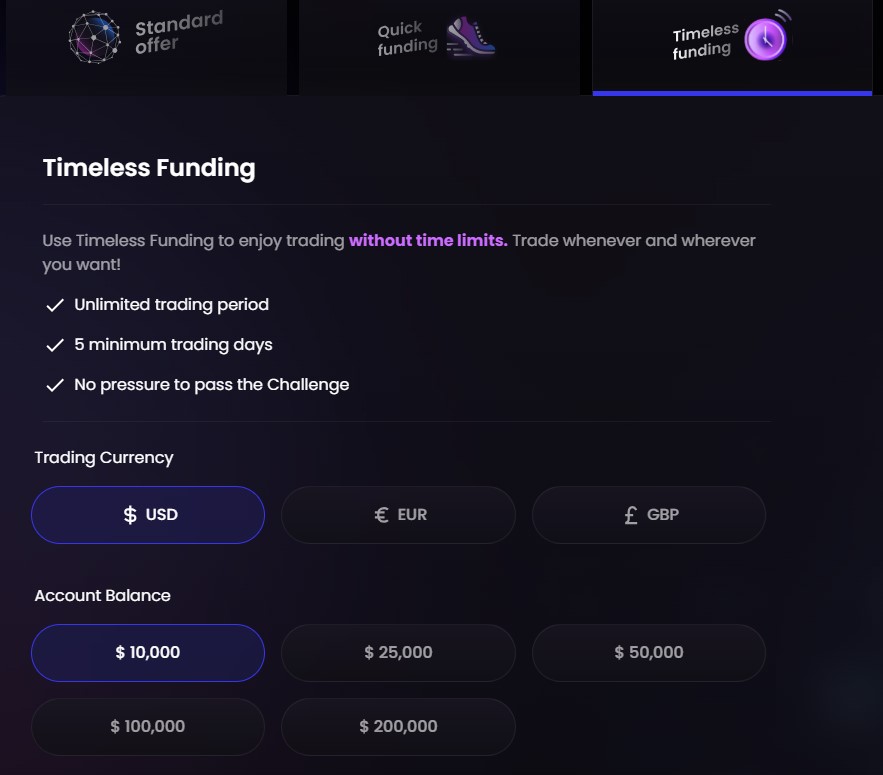

Timeless Funding Program

True Forex Funds Timeless Funding program empowers traders to manage portfolios from $10,000 to a substantial $200,000. The objective is to spotlight traders with a knack for profitability and adept risk management across a dual-phase evaluation. Timeless Funding provides the advantage of trading with leverage up to 1:100, along with the choice of USD, EUR, or GBP for account funding.

| Account Size | Price |

|---|---|

| $10,000 | €98 |

| $25,000 | €208 |

| $50,000 | €329 |

| $100,000 | €549 |

| $200,000 | €1,098 |

Evaluation Process

Phase One: Here, traders aim for an 8% profit target, ensuring they stay within the boundaries of a 5% maximum daily loss and a 10% overall loss limit. Unique to this phase is the absence of a maximum trading day limit, although a minimum of five trading days is required to progress to the next phase.

Phase Two: This stage sets a 5% profit target, with the same daily and overall loss limits as the first phase. Similar to phase one, there’s no upper limit on the number of trading days, but a minimum of five days of trading is essential to move forward to a funded account.

Successful completion of both phases leads to a funded account with no minimum withdrawal restrictions. Compliance with the 5% daily loss and 10% maximum loss rules remains crucial. The initial payout is scheduled 14 days after the first trade in the funded account, with subsequent bi-weekly withdrawal opportunities. Profit distribution is set at 80% of the earnings made on the funded account.

Timeless Funding Scaling Strategy

Timeless Funding also incorporates a scaling plan. Traders who demonstrate consistent profitability over three months, averaging an 8% return, and executing at least three successful withdrawals, become eligible for a 25% increase in their account size.

Scaling Milestones:

- After 3 Months: A $100,000 account that meets the criteria increases to $125,000.

- Following the next 3 Months: A $125,000 account, upon qualifying, grows to $150,000.

- After another 3 Months: A $150,000 account, maintaining its qualifying status, escalates to $175,000.

Timeless Funding Trading Regulations & Objectives

- Profit Target: Traders must hit a set profit percentage to conclude an evaluation phase, withdraw profits, or upscale their account. Phase 1 requires an 8% profit, while Phase 2 aims for a 5% target. Funded accounts are not bound by specific profit targets.

- Maximum Daily Loss: It’s the upper limit of loss a trader can incur in a single trading day without violating the account’s limits. All accounts have a 5% cap for daily losses.

- Maximum Loss: This is the total loss threshold a trader can reach without breaching the account. A 10% limit is set for all account sizes.

- Minimum Trading Days: The least number of trading days required before successfully concluding an evaluation phase. Both phases necessitate a minimum of 5 trading days.

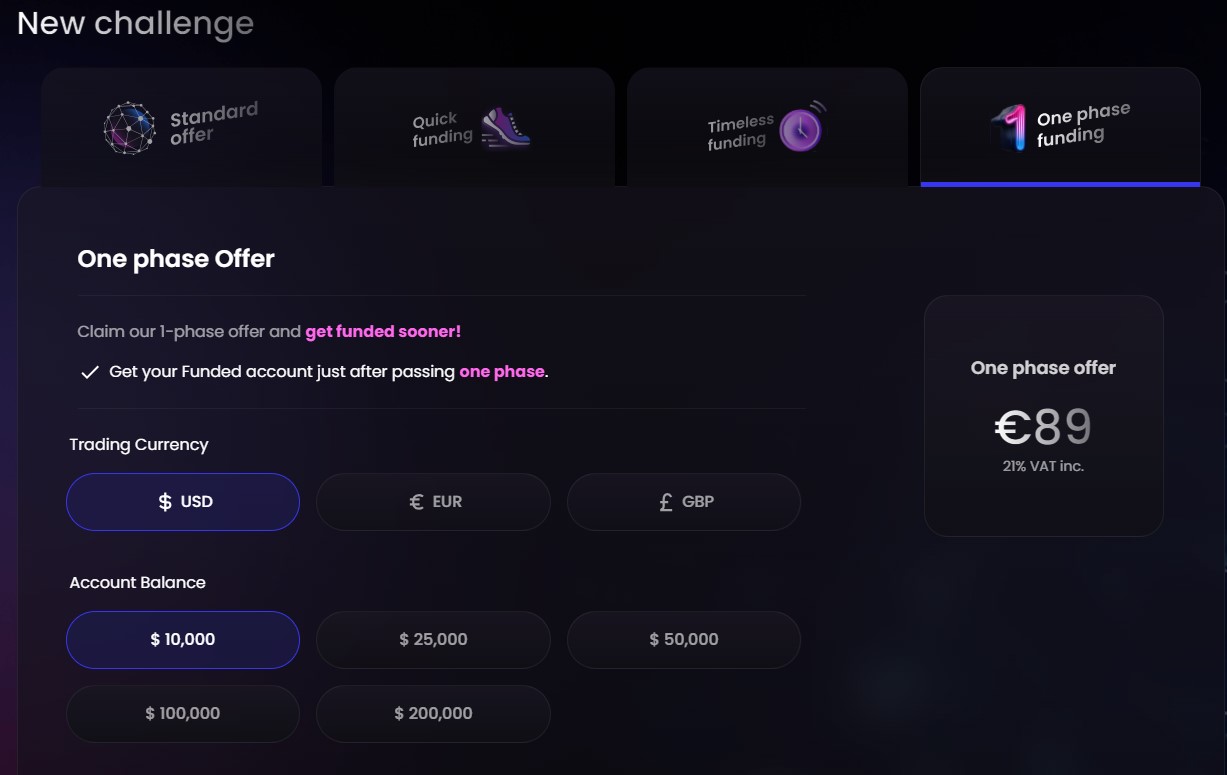

One-phase Funding plan

True Forex Funds‘ One-phase Funding offers traders the chance to handle accounts from $10,000 to $200,000. This initiative is tailored to recognize traders who show both profitability and disciplined risk management in a streamlined, one-step evaluation. With One-phase Funding, you get the advantage of trading with up to 1:30 leverage and the choice of funding in USD, EUR, or GBP.

| Account Size | Price |

|---|---|

| $10,000 | €89 |

| $25,000 | €189 |

| $50,000 | €299 |

| $100,000 | €499 |

| $200,000 | €998 |

Evaluation Guidelines

The evaluation requires traders to achieve a 10% profit target while staying within a 3% maximum daily loss and a 6% overall loss limit. Time is of the essence here; you have 30 calendar days to meet the profit target. Additionally, a minimum trading period of 5 days is necessary to move forward to a funded account.

Successfully passing the evaluation phase leads to a funded account with no restrictions on minimum withdrawals. It’s important to adhere to the 3% daily loss and 6% overall loss rules. The first payout is scheduled 14 days after initiating your first position in the funded account, with the option for bi-weekly withdrawals thereafter. The profit share is a generous 80% of the profits earned on your funded account.

Scaling Plan of One-phase Funding

The One-phase Funding program includes a progressive scaling plan. If you’ve been profitable over the last three months, achieving an average return of 8% over this period, and have made at least three successful withdrawals, you become eligible for a 25% increase in your initial account size.

Scaling Milestones:

- After 3 Months: A $100,000 account meeting the criteria grows to $125,000.

- In the Subsequent 3 Months: Upon qualification, a $125,000 account rises to $150,000.

- Following Another 3 Months: A consistent $150,000 account advances to $175,000.

Trading Rules & Goals for One-phase Funding

- Profit Target: A critical goal where traders must hit a 10% profit to complete the evaluation phase, withdraw earnings, or upscale their trading account. Funded accounts aren’t restricted by set profit targets.

- Maximum Daily Loss: Each account size is capped with a 3% loss limit per trading day to prevent breaching the account’s terms.

- Maximum Loss: This is the overall loss limit set at 6% across all account sizes to ensure account integrity.

- Minimum Trading Days: There’s a requirement of at least 5 trading days to successfully wrap up the evaluation phase.

- Maximum Trading Period: A 30-day window is provided to reach the necessary profit target and complete the evaluation.

What broker does true forex funds use?

True Forex Funds stands apart in its brokerage approach, opting not to align with typical broker brands. Instead, they have formed a strategic alliance with a premier tier-1 liquidity provider, renowned for offering the most authentic simulated market trading conditions.

Regarding trading platforms, True Forex Funds offers flexibility. While trading under their wing, you have the option to use either MetaTrader 4 or MetaTrader 5, both esteemed in the trading community.

Trading Instruments at True Forex Funds

Partnering with a tier-1 liquidity provider, True Forex Funds ensures traders access the finest simulated real market trading scenarios. The platform extends an array of trading instruments, including forex pairs, commodities, indices, stocks, and cryptocurrencies. Leverage possibilities reach up to 1:100, varying with your chosen trading instrument and the specific funding program you’re enrolled in.

Forex Pairs Collection

- Australasian Pairs: AUD/USD, AUD/CHF, AUD/JPY, AUD/NZD

- North American Pairs: CAD/CHF, CAD/JPY, USD/CAD, USD/CHF, USD/HKD, USD/MXN

- European Pairs: EUR/AUD, EUR/CAD, EUR/CHF, EUR/JPY, EUR/NOK, EUR/NZD, EUR/PLN, EUR/SEK, EUR/TRY, EUR/USD, GBP/AUD, GBP/CAD, GBP/CHF, GBP/JPY, GBP/NZD, GBP/USD

- Asian Pairs: CHF/JPY, NZD/CAD, NZD/CHF, NZD/JPY, NZD/USD, USD/JPY, USD/SGD

- Exotic Pairs: USD/NOK, USD/PLN, USD/RUB, USD/SEK, USD/TRY, USD/ZAR

Commodities List

- Precious Metals: XAU/USD, XAG/USD, XPD/USD, XPT/USD

- Energy Assets: BRENT, NGAS, WTI

Indices

- Global Markets: AUS200, CHININD, EU50, FRA40, GER30, HKIND, ITA40, JAP225, SPA35, UK100, US100, US30, US500

Cryptocurrencies

- Digital Currencies: ADA/USD, AVE/USD, BCH/USD, BNB/USD, BSV/USD, BTC/EUR, BTC/USD, DOG/USD, DOT/USD, DSH/USD, EOS/USD, ETH/BTC, ETH/USD, LNK/USD, LTC/USD, THT/USD, TRX/USD, UNI/USD, USD/BIT, VET/USD, XEM/USD, XLM/USD, XMR/USD, XRP/EUR, XRP/USD, XTZ/USD

Stocks

- Major Corporations: ADS, AIR, ALIBABA, AMAZON, APA, APPLE, BMW, BOA, BOEING, CITI, DAI, DISNEY, EBAY, EXXON, FB, FERRARI, FORD, FP, GM, GME, GOOGLE, GS, HEIA, IBM, INTEL, JPM, KO, LMT, MC, MCDN, MRNA, MSFT, NESN, NFLX, NIOI, PEPSI, PG, QLCOM, RDSA, SBUX, SIE, SNAP, TESLA, VOW, WMT, ZM

Trading Fees

| Trading Instrument | Commission Fee |

|---|---|

| FOREX | 7 USD / LOT |

| COMMODITIES | 7 USD / LOT |

| INDICES | 0.0005% per Side |

| CRYPTO | 0.045% per Side |

Spread Account

Login on the trading account below to see the live spreads.

| Platform | Server | Login Number | Password |

|---|---|---|---|

| MetaTrader 4 | TrueProprietaryFunds-DEMO | 1109374041 | TFFspreads |

True Forex Funds Trustpilot reviews

True Forex Funds‘ Stellar Reputation on Trustpilot

True Forex Funds shines on Trustpilot, thanks to glowing feedback from its vibrant community. The platform has become a beacon of positive reviews, showcasing a wide array of satisfied clients praising their services. With an admirable average of 4.6 out of 5 stars, based on a hefty 2,798 reviews, the firm stands out in its sector. It’s particularly noteworthy that a whopping 87% of these reviews have given True Forex Funds the ultimate accolade of 5 stars, highlighting the firm’s exceptional performance and customer satisfaction.

Summary and Recommendation for True Forex Funds

Summing up, True Forex Funds establishes itself as a credible and reliable proprietary trading firm, offering traders a selection of five distinct funding programs. These include the Standard Offer, Quick Funding, and Timeless Funding, which involve a two-step evaluation process, and the One-phase Funding, characterized by a single-step evaluation.

The Standard Offer at True Forex Funds is a benchmark two-step evaluation, culminating in the opportunity to handle a funded account with an 80% profit share. Traders are tasked with achieving profit targets of 8% in the first phase and 5% in the second phase to secure funding. With realistic trading goals set against a backdrop of 5% maximum daily and 10% overall loss guidelines, traders also face a minimum of 5 trading days in both phases, alongside a maximum period of 30 days in phase one and 60 days in phase two. An enticing aspect of the Standard Offer is the scaling plan, offering a chance to augment the initial account balance.

Summing up Quick Funding

In the realm of Quick Funding, True Forex Funds maintains the industry standard with a two-phase evaluation leading to fund management and an 80% profit split. Here, traders aim for 8% and 5% profit targets in phases one and two, respectively. The program’s appeal lies in its absence of minimum trading day requirements, although it sets a maximum duration of 30 days for the first phase and 60 days for the second. The Quick Funding also includes a scaling plan to potentially increase the initial account size.

True Forex Funds‘ Timeless Funding mirrors the two-step evaluation structure, paving the way to manage a funded account and earn an 80% profit share. Traders must meet 8% and 5% profit targets in the consecutive phases, adhering to the 5% daily and 10% overall loss rules. Unique to Timeless Funding

is the flexibility with no maximum trading day constraints in both phases, balanced by a requirement of a minimum of 5 trading days. Like its counterparts, it also features a scaling plan for account enhancement.

The One-phase Funding option simplifies the journey with a one-step evaluation process. Traders need to hit a 10% profit target, respecting the 3% daily and 6% maximum loss limits. The evaluation phase comes with a 5-day minimum trading requirement and a 30-day maximum period. Importally, this program also includes a scaling plan, offering an increase in the initial account size.

Conclusion

For those seeking a reputable proprietary trading firm, True Forex Funds stands out with its diverse offerings catering to various trading styles. Key highlights include the unlimited trading period in Timeless Funding, no minimum trading day requirement in Quick Funding, the possibility of an initial withdrawal after just 14 days, and bi-weekly payouts thereafter. Taking into account all that True Forex Funds offers to global traders, it firmly positions itself as a frontrunner in the proprietary trading firm landscape.

Add a Comment